Article IT outsourcing best practices for a wealth management company

By Insight Editor / 10 Aug 2018

Top 5 Best Practices for Outsourcing Your Wealth Management IT Needs

From an uncertain macroeconomic climate, mounting pressure on wealth managers to reduce fees and dropping return-on-investment in equity and bond markets (Financial Times), firms are under pressure to find ways to reduce their operational expenses.

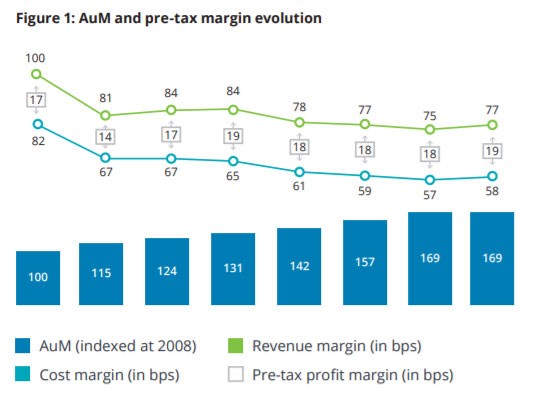

For example, despite a recovery in assets under margin (AuM) following the Great Recession in 2008, growth has largely been stagnant for the wealth management industry in 2014-2015.

Growth in Assets Under Margin (AuM): 2008-2015

Of the solutions sought by wealth managers is business process outsourcing (BPO), namely IT operations and other non-”strategic” (e.g. advisory) roles to managed service providers (MSP).

In fact, Deloitte estimates that 64% of wealth managers are “considering” to outsource their IT solutions, while Accenture notes that 40% of wealth managers are prioritizing efficiency gains as part of their IT outsourcing efforts.

Granted, the advantages of outsourcing IT are well-known, but not all wealth management firms are the same and, in turn, nor are their respective IT needs. We’ve compiled the leading five best practices to implement when beginning your firm’s IT outsourcing project below.

1. Identify What Needs Outsourcing

To extract the most out of your wealth management firm’s IT outsourcing, you need to start with identifying what needs to be outsourced to an external managed service provider (MSP).

Differences in company size, region/location, near and long-term plans and many other factors mean that there’s no one-size-fits-all approach for wealth managers – every case is unique.

First, wealth managers are generally unlikely to outsource advisory or “core” tasks out to MSPs (Deloitte), so the balance of what will be outsourced falls in business process operations (BPO), which can include (though not necessarily cover every aspect of) daily IT operations.

Deloitte recommends that wealth managers keep “strategic activities” — i.e. those tasks that are “mainly business specific” or “differentiating” — in-house. However, many IT operations, including data management, are not “strategic” or “core” so they are candidates for outsourcing.

In general, Deloitte finds that smaller wealth managers are likelier to outsource most, if not all, of their IT operations to a MSP so as to secure “access leading-edge technology without having to invest in it themselves.”

2. Secure a Proper Service Level Agreement

Part and parcel with relying on a MSP is that your wealth management firm will lose control (to varying degrees) of its daily operations to an outside provider.

However, the cost and efficiency benefits of IT outsourcing are genuine, so the problems aren’t MSPs per se; rather, it’s about ensuring that your MSP and your firm are on the same page.

You need to secure a service level agreement (SLA) that fulfils your unique IT needs.

Be it guaranteed uptime, a guarantee of when and how your MSP will respond to your IT issues or a clearly-defined disaster recovery process, a SLA will help ensure that nothing between you and your MSP is unclear or ambiguous.

Ultimately, not only are you relying on a MSP, but you’re also expecting decisive outcomes in terms of controlling your escalating IT costs and freeing you to focus on managing wealth.

In fact, Deloitte outlined that financial services firms are looking at outsourcing “as a vital way to drive innovation into the enterprise … attaining and maintaining a competitive advantage.” Thus, you should build an SLA that makes your MSP into an asset, not a liability.

3. Mitigate the Risk of Unforeseen Costs

There’s little point in outsourcing your IT operations if doing so fails to accrue the intended cost savings. Broadly, a MSP frees you from worrying about infeasible capital expenditure (CAPEX) that can involve hiring and procurement (and indirect costs, such as electricity for hardware).

Why OPEX?

Instead, relying on an MSP lets you convert your IT spend into a manageable – and scalable – operational expenditure (OPEX) for IT services.

A big advantage of OPEX is that it frees your company from sunk costs (e.g. infrastructure) and can be adjusted based on the firm’s current usage. So if you estimate fewer IT needs in the next three years, you can opt for fewer IT services in your next SLA.

To achieve genuine long-term savings, ensure that you and your MSP are on the same page in terms of the intended goals. One mistake some wealth managers (and MSPs) make is not fully identify potential costs in their projections, thus resulting in overly optimistic forecasts.

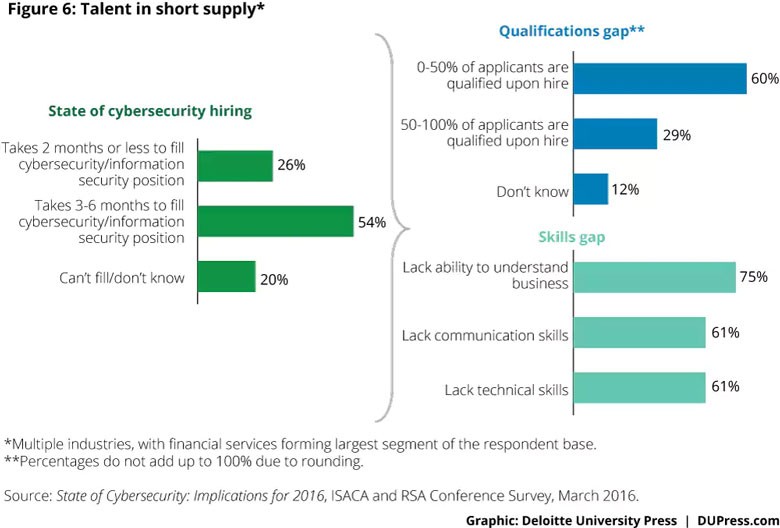

4. Security is Top of Mind

Security is integral to the success of your wealth management company.

Be it ensuring that your clients’ data (including their personally identifiable information: PII) is not vulnerable to breaches or maintaining your firm’s credibility, you cannot afford to compromise on cybersecurity.

The Cybersecurity Gains of Outsourcing IT

However, when relying on an external MSP, you must accept that your data — and other critical assets — are likely to extend beyond your wealth management company. In other words, you’re accountable for the cybersecurity measures (or lack thereof) taken by your MSP.

When outsourcing, you must understand your regulatory environment (i.e. what local, regional or international laws apply to your firm), identify the assets in need of securing, understand the cyber threat landscape and identify, as well as seal your IT security vulnerabilities.

In effect, you must treat the MSP as an extension of your own operations, and in turn, look at its cybersecurity practices as though they were your own. Gaps on your MSP’s side could return to harm you later in the form of a cyber attack and/or regulatory penalties.

5. Compliance

It’s important not to get caught up in the cost-benefits of outsourcing and, as a result, forget about your wealth management firm’s regulatory compliance obligations.

For example, how you collect, manage, process and use client data – including client PII – is a matter of regulatory concern, especially in Europe via the General Data Protection Regulation (GDPR). Failure to comply could result in costly government penalties.

By extension, how your MSP manages your clients’ data directly reflects upon your firm. From ensuring that the data is securely stored (e.g. through HIPAA-compliant data centres) to having strong reporting mechanisms available, your firm is responsible.

Next Steps

It’s clear that achieving what’s best for your wealth management firm’s IT outsourcing needs is contingent on experience. Basically, a MSP with prior experience providing IT solutions to other wealth management firms will help you navigate these difficult issues right from the start.