Article Best Practices for Managing Costs in Wealth Management IT

By Insight Editor / 4 Jul 2018

The wealth management industry is under pressure from a variety of sources. From demands for lower fees to relatively lower returns on equity and bond markets, margins are tight. With macro-economic conditions as they are — i.e. artificially low interest-rates and slow economic growth in developed countries — wealth managers are limited in their investment options.

In addition, wealth managers must also contend with the costs of compliance and cybersecurity.

Not only is regulatory compliance costly and complex, but it’s constantly evolving and punitive (if the firm fails to fulfill its relevant standards). In 2017, Accenture had reported that the number of firms spending over 5% of their net-income compliance grew by 40% since 2016.

Factors Pressuring the Financial Services Industry

In tandem, cybersecurity is demanding increasing investment, not least from the perspective of anti-money laundering (AML), but hacking and protecting client data as well. In fact, regulators have sought to drive changes in these areas for years, with the European Union’s (EU) General Data Protection Regulation (GDPR) being the most recent example to come into force.

Wealth Managers Have High IT Costs

It isn’t surprising that the focus has shifted to controlling operating costs, especially IT costs.

The wealth management industry — much like the financial services industry as a whole — has very high IT costs. Though much of this certainly has to do with compliance and security, the bulk of IT budgets in the wealth market space are consumed in maintenance. In fact, capital markets spend over 70% of their IT budgets on maintenance (i.e. nearly $80 billion a year).

Besides reducing the firm’s capacity to invest in new technologies, high IT maintenance spending is a risk. As compliance and cybersecurity needs evolve, so too will the IT needs.

However, if insufficient funding is in place to sustain new hardware, software, services and talent procurement, then wealth managers could end up compromising on much needed upgrades. A scenario such as this would leave wealth managers exposed to cybersecurity threats as well as non-compliance. In addition, better-equipped competitors will move ahead in the market.

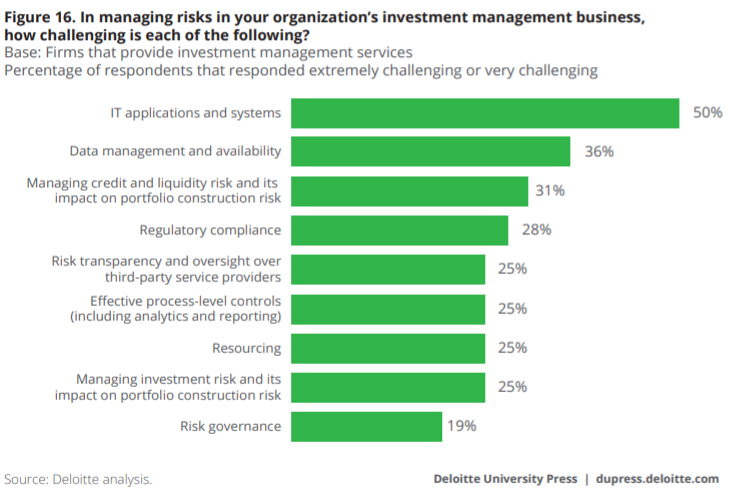

In its 2016 Global Risk Management Survey of the Financial Services Industry, Deloitte learned that 50% of wealth managers, investment firms and other capital market entities were having a significant amount of difficulty with managing risk around their IT systems.

Though not confined to the wealth management or financial services industry, studies found that small and medium-sized businesses spend more of their net-income on IT than their enterprise counterparts. This is likely to be true of boutique and niche wealth management firms as well.

Looking at the concerns of smaller firms, one can imagine how badly they would be impacted by additional increases in compliance, security and IT advancement costs.

Optimizing IT costs are evidently of interest to wealth managers, but doing so without reducing current and future IT effectiveness requires careful planning. In fact, PwC outlined that proper and holistic IT planning could generate cost savings of up to 50% compared to ad hoc efforts.

Best Practices for Managing Your IT Costs

Determine Your IT Department’s Exact Role

First, determine the exact role of your IT department. You should begin by engaging your firm’s internal stakeholders and identify the tools they require and their primary concerns. It’s vital that your wealth management firm also defines and commits to an IT department objective.

For example, do you intend to use your IT department for mostly system maintenance work or leverage more (if not most) of your internal IT resources on strategic programs that are aligned with your current objectives in the wealth management market?

Once you’ve determined your IT department’s actual purpose, you can proceed with pursuing new solutions, including those designed for optimizing your IT expenditure.

Improve Your Business Processes

Besides your workforce and technology, the effectiveness of your IT system also rests on your business processes. Consider adopting current standards such as the Information Technology Infrastructure Library (ITIL). ITIL provides guidelines and standards for managing IT systems and is widely viewed as an effective instrument for controlling IT costs.

Leverage Project Management

Use a project management team to keep your wealth management firm’s strategic interests at the forefront of any IT project. Because project managers prioritize business success, you can rely on them to optimize your costs and, if necessary, stop an unnecessary IT project.

Use the Cloud

The cloud offers a significant opportunity for wealth management firms, especially boutique and niche wealth managers, to acquire tailored and powerful IT capabilities at minimal cost.

Through the cloud, businesses can store client data, confidential information, backups and applications with external cloud providers that will cover all of your maintenance, security and optimization needs at a simple per-user and per-term (e.g. year) model.

If your needs decrease, you can reduce the scope of your service and lower your long-term costs accordingly. This frees you from risking heavy capital expenditure to enhance your IT capabilities – if your needs decrease, you’ll still be on the hook for the fixed overhead costs.

Utilize Managed IT

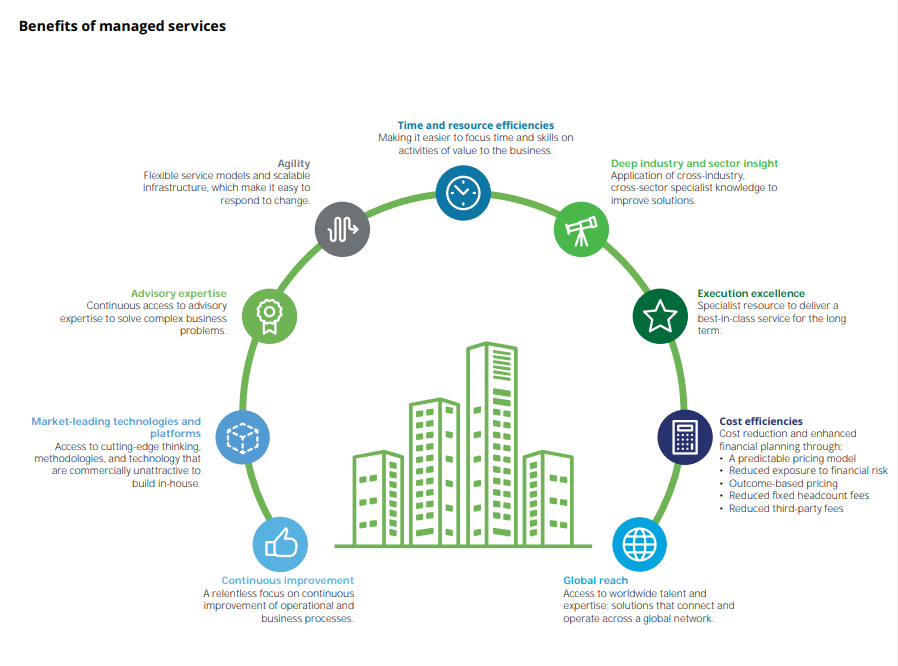

In terms of cost optimization, managed IT services should be at the forefront of your long-term IT planning. In 2016, Deloitte concluded that not only were financial institutions using managed IT services to reduce costs, but “potentially attaining and maintaining a competitive advantage.”

Because it’s increasingly difficult to secure suitably skilled and experienced IT talent, especially for mission-critical areas such as cybersecurity, financial services firms are beginning to rely on managed IT service providers (MSP) to bring that talent to the table. In effect, financial services firms are using MSPs to effectively incorporate new technologies while avoiding the high-costs and loss of time seeking to add that expertise to their internal IT teams.

The Benefits of Managed IT Services

MSPs also alleviate the less noticeable costs of an IT system. For example, it often requires IT professionals to work overtime, especially for bug-fixing, overcoming a system failure and other issues. Likewise, your IT infrastructure also adds to your utility costs by consuming electricity for powering your systems and cooling them.

In the long-term, a MSP enables you to adjust your IT expenditure into a predictable cost that you can control (i.e. reduce or increase) in alignment with your needs.

By assuming the role of managing your IT system, the MSP frees you to use more of your resources towards your wealth management firm’s strategic objectives (e.g. reducing client fees) without sacrificing the effectiveness of your IT system.

Secure a Favourable Service Level Agreement (SLA)

If you incorporate a MSP to support your IT needs, then it’s imperative that you secure the right service level agreement (SLA). A SLA comprises of mutually agreed-upon terms outlining what the MSP owes you in terms of your IT system’s service levels, response time for IT issues and critical aspects you’ll need defined ahead of time to keep your system running.

Besides a favourable SLA, your wealth management firm should select an MSP that is actually experienced in your industry. This is important because you need IT solutions that both match your exact requirements (e.g. access to secure hosting for your data) while also complying with your industry’s compliance requirements. Not complying with the GDPR, Markets in Financial Instruments Directive (MiFID), Basel Committee and others could result in costly penalties.

Begin the process of selecting the right MSP by asking for your candidates’ wealth management industry experience, their compliance standards and industry partnerships.

Vendors important because MSPs with tier-one (e.g. Gold) partnerships with giant IT vendors — including Microsoft, Adobe, Cisco, HP, VMware and Dell — will ensure that your business will run on the best IT hardware, software and services. Finally, ensure that your MSP’s IT experts possess certifications reflective of today’s (and ideally, tomorrow’s) standards and technologies.